does texas have an estate tax

Washington doesnt have an inheritance tax or state income tax but it does have an estate tax. EFFECT OF EXTENSION OR DEFICIENCY IN PAYMENT OF ESTATE TAXES.

The Estate Tax is a tax on your right to transfer property at your death.

. His assets were held in a living trust that became an irrevocable trust upon his death. Texass median income is. Estate tax is based on your legal state of residence not where you die.

Ad From Fisher Investments 40 years managing money and helping thousands of families. The states with this powerful tax combination of no state estate tax and no income tax are. However less than 1 of the population in Texas or even in the United States needs to worry about this.

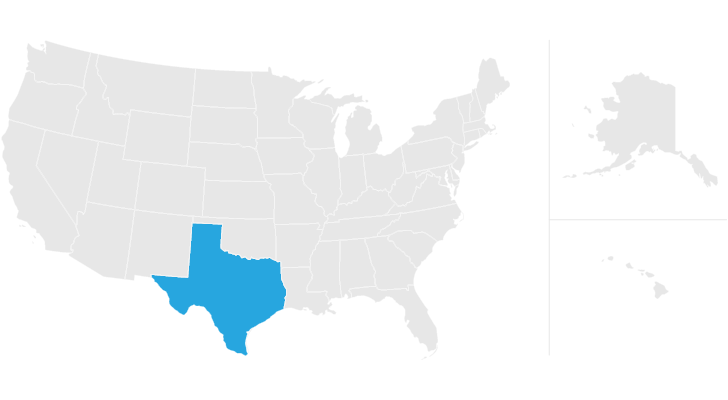

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas and Wyoming. A If the date for the payment of any portion of an estate tax is extended. Texas does not have an estate tax and the federal estate tax only applies to estates whose assets are worth well over 11 million.

However as the exemption increases the minimum tax rate also increases. Texas ended its state inheritance tax return for all persons dying on or after January 1st 2005. Counties in texas collect an average of 181 of a propertys assesed.

So until and unless the Texas legislature changes the law which is always a possibility youll likely not owe any Texas inheritance or estate tax. Unless a taxable entity qualifies and chooses to file using the EZ computation the tax base is the taxable entitys margin and is computed in one of the following ways. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

There is a 40 percent federal. The 1041 federal return was for the estate of my father who died in the middle of 2018. There is a 40 percent federal tax however on estates over 534 million in value.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. It is one of 38 states with no estate tax. At the state level there is not an estate tax in Texas to be concerned about by anyone but at the federal level there is.

That said you will likely have to file some taxes on behalf of the deceased including. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Total revenue times 70 percent.

While its very beneficial that Texas doesnt have a transfer tax it does come at an expense. The higher exemption will expire Dec. Its inheritance tax was repealed in 2015.

What Is the Estate Tax. It only applies to estates that reach a certain threshold. The state repealed the inheritance tax beginning on Sept.

Near the end of the interview procedure TurboTax stated. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. However localities can levy sales taxes which can reach 75.

This is because even though an estate tax still exists on the books for the IRS the size of the exemption is so large that it applies to very few. Does Texas have an estate tax. If the estate is large enough then it may have to pay estate tax.

Total revenue minus cost of goods sold COGS. Higher rates are found in locations that lack a property tax. Total revenue minus compensation.

Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. In some cases heirs may have to pay tax as well depending upon the type of. Alaska is one of five states with no state sales tax.

Final individual federal and state income tax returns. You are required to file a state business income tax return in. Texas has no state property tax.

Each are due by the tax day of the year following the individuals death. While for the most part the national average as far as property taxes go sits around 12 its upwards of 19 and even higher in some areas of Texas. Property Tax System Basics.

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Texas has a 0 state capital gains tax. As long as the estate in question does not have assets exceeding 1170 million for 2021 or 1206 million in 2022 you are most likely not on the hook for federal estate or inheritance taxes.

The Comptrollers office does not collect property tax or set tax rates. There are no inheritance or estate taxes in Texas. Thats up to local taxing units which use tax revenue to provide local services including schools streets and roads police and fire protection and many others.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Texas has no income tax and it doesnt tax estates either. Texas has only local property taxes levied by local taxing units.

And as anyone whos ever searched a gov website knows information isnt always easy to find and laws are constantly getting updated. Texas Estate Tax. While the nations average property tax rate is 107 Texas homeowners have to pay much more.

Sometimes the assets are subject to probate. The bottom line is this. Texas does not levy an estate tax.

The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. Sales tax isnt something you want to guesstimate. Also good news over 90 percent of all Texas estates are exempt from federal estate taxes.

The maximum federal estate tax rate is 40 percent on the value of an estate above that amount. Its also best contact someone from your state if you still have questions about taxes at your estate sale. In Texas the assets that are left behind after a person dies become part of the deceaseds estate which is distributed to heirs and others through a variety of processes.

Theres no personal property tax except on property used for business purposes. Franchise tax is based on a taxable entitys margin. The state business return is not available in TurboTax.

These are some of the most expensive Texas counties property tax-wise. Texas has some of the highest property taxes in the entire country. Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services.

Texas law establishes the process followed by local officials in determining the value for property ensuring that values are equal and. The sales tax is 625 at the state level and local taxes can be added on. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirs.

Connecticut continues to phase in an increase to its estate exemption planning to match the federal exemption by 2023. Texas also imposes a cigarette tax a gas tax and a hotel tax. Learn about the role and services offered by the.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. 1 the amount of the extended tax shall be apportioned to the persons who receive the specific property that gives rise to the extension. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Hoa Tax Return Guide Moneyminder Tax Return Tax Estate Tax

Call Kelly At 469 631 5893 Home Buying Estate Tax Real Estate

What Is Estate Planning Basics Checklist For Costs Tools Probates Taxes Estate Planning Estate Planning Attorney Estate Tax

What Qualifies As A Homestead The Word Homestead May Conjure Up Images Of Pioneers Staking Their Claim On Th Republic Of Texas The Conjuring Things To Sell

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Sales And Use Tax Rates Houston Org

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem Real Estate New Homeowner Estate Tax

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Pin By Cathy Searcy On Ceramic Park City Ceramics Tableware

States With The Highest And Lowest Property Taxes Property Tax States Tax